Each applicant and all occupants aged 18 or above are required to individually complete, date, and sign a distinct rental application. For multiple adults applying for the same unit, a collective screening process is conducted. However, aside from income, which is aggregated, each applicant must satisfy all rental criteria independently. The approval process is carried out by an external Application Processing Agency, ensuring confidentiality, and a privacy policy is available upon request.

Approval, conditional approval, or denial are determined based on the review of specific criteria:

Availability Policy: Homes are pre-leased when the current resident provides notice to vacate. Vacant homes with pending or approved applications are not considered available.

Age Requirement: Leaseholders must be 18 or older. All occupants aged 18 or above must submit an application and pass criminal and rental credit reports.

Renter’s Insurance Requirement: It is required to maintain personal liability insurance.

Identification: For your protection, each applicant must provide a valid government-issued photo identification and allow it to be photocopied.

Occupancy Standard: The occupancy standard is Two persons per bedroom. If the addition of a minor to the household, through birth, adoption, custody change, guardianship, or other circumstances causes the household to be over-occupied, the household may remain in the current unit through the end of their lease or 6 months, whichever is longer.

Pet Policy: Pets are subject to management approval, and assistive/service animals are exempted but require documentation.

Employment and Income Requirements/Verification:

At least ONE year of continuous and verifiable employment history and legal income are necessary.

Total combined gross monthly income must be two and a half times the monthly market rent.

Applicants will be required to show proof of at least ONE consecutive month of legal income.

Acceptable proof of income includes, but is not limited to, pay stubs or other verification from employer, previous year’s tax returns and bank statements, investment income statements, proof of receipt of retirement, social security, disability, welfare, child or spousal support or any other legal income.

Student applicants attending college will be accepted as an alternative to being employed; however, a student must obtain a qualified guarantor

Rental/Mortgage History:

Verifiable history of at least 12 months with positive rental/mortgage payments.

Poor history includes more than two late payments or more than one eviction proceeding in a 12-month period.

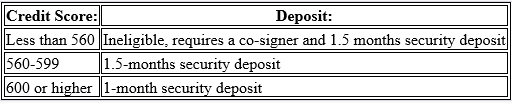

Credit History & Deposit Requirements: Credit reports are obtained, and an acceptable credit history is required. Medical and student loan accounts are exempt.

Criminal History: A criminal history report is requested, and certain convictions may result in automatic denial.

Within the past 5 years, must be free of felony charges; Within the past 5 years Must be free of Misdemeanor & unclassified charges related to: violence or drugs

Any person convicted for crimes of a sexual nature, designated as a sexual predator/offender, or under consideration by any court for being declared a sexual predator/offender will not be accepted.

Guarantors – Guarantors must have a gross monthly income at least 4 (four) times the entire monthly market rent and must fully meet all other qualifications as outlined above.

The guarantor must complete and sign a lease guaranty agreement. Guarantors must be aware that they are guaranteeing the entire Lease agreement regardless of the number of persons listed on the lease agreement

References:

Three personal references required

Two landlord references or two years of mortgage payment history required

Applicants may be denied for reasons such as falsification of the application, insufficient income, more than one eviction proceeding, incomplete application, insufficient employment history, or unsatisfactory rental/mortgage history.

Exceptions for approval or lease guarantee may apply in cases of inability to verify information, no established credit history, being a first-time renter, or resolving past issues.

Guarantors must meet specific income requirements and fully comply with outlined qualifications. The Fair Housing Policy emphasizes non-discrimination based on various factors.

The Resident Criteria is a guideline to accept creditworthy individuals without a criminal background. However, meeting these criteria does not guarantee conformity from all individuals residing in or visiting the homes.

Applicants acknowledge that decisions are based on third-party information, and if rental qualifications are not met or false information is provided, the application may be rejected, and fees retained. Background checks may include contact with landlords, employers, credit agencies, law enforcement, and personal references.

Upon approval, holding fees and prepaid amounts are non-refundable.